| Customer financing is an option given by respective businesses to their customers facing budget constraints, as it allows them to make payments over time. |

According to a February 2024 Report, 71% of consumers prefer payment plan options to buy services or products. This indicates that more and more businesses need to incorporate customer financing solutions into their sales strategy, especially for the new-age customers comprising millennials and Gen Z.

That said, let’s delve deeper into the customer financing options, understand how they work, and their importance from a business’s perspective.

| What You’ll Learn: 1. What Is Customer Financing? 2. Why Should Your Business Offer Customer Financing Options? 3. How Does It Work? 4. How Do I Offer My Customers Financing Options? 5. What Are the Top Customer Financing Solutions? 6. How to Integrate Customer Financing Solutions? |

What Is Customer Financing?

It is a way to offer your customers payment options that they can use to pay in flexible installments. It’s ideal for a business to attract more frequent buyers and a convenient option for the customers to pay over time.

For instance, let's say you provide cosmetic dentistry services. A patient needs veneers to improve their smile but can’t pay for them all at once. So, in that case, you can set up some financing options, and allow your patients to split costs into manageable installments. This way you get the cash flow you need for your practice and your patients get an opportunity to pay with ease.

Enhance Revenue Management and Collection Efficiency with CredeeBill.

Why Should Your Business Offer Financing To Customers?

Offering customer financing gives businesses increased opportunities to attract more costumes and improve sales. Similarly, it is also a viable option to make services more affordable and accessible. There are a wide range of third-party solutions out there, such as Credee. These options help you get your payments on time.

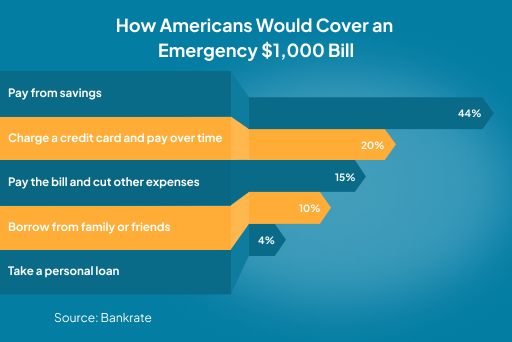

| Did You Know? 56% of Americans face difficulty paying for services upfront, while only 44% of U.S. adults can cover an emergency $1k bill. |

Here’s another example to help you put things into perspective, let’s say a patient needs an emergency root canal. Now, uninsured patients may struggle to pay $700–$900 for an emergency root canal. However, if you offer financing and let them choose a payment option to break the cost in installments, say $150 monthly, it alleviates their burden. Moreover, it’ll encourage them to choose your services again and even recommend them to others.

What Are The Different Types Of Customer Financing?

There are two main categories of customer financing:

- In-house financing that you can manage yourself

- Third-party customer financing programs or solutions

1. In-House Financing

It means you create the payment plans, set your terms and conditions, and manage collections using in-house resources. It is generally ideal for large-scale companies.

Pros:

- You have complete control over the contract's terms

- You can create customized plans as needed

Cons:

- You’ll need an in-house team

- The staff may need training as they may lack expertise in payment plan management and collections

- All the hassle falls on your in-house team

- There may be some legal compliance risks associated with managing in-house financing

2. Third-Party Customer Financing Solution

Whether you run a small business or a medium to large business, third-party financing can be the answer. If you choose this option, you can leave the hassle of collecting payments and managing plans to the provider.

Pros:

- You receive the full payment upfront

- The provider takes over collections

Cons:

- No control over contract terms

- Lowers the opportunities to build direct customer relationships

- The provider charges a service fee per transaction from the business

While both have their pros and cons, there are other alternative options that effectively address the shortcomings of the methods mentioned earlier.

| Take, for example, the integration of payment plan solutions like Credee. It provides a level of control with clear and transparent terms. Credee offers a variety of payment plans, each with its own set of perks. These plans allow businesses to offer an interest-free period, while also ensuring a steady stream of recurring revenue. |

What Type Of Customers Financing Options Can I Offer To My Customers?

Offering customer financing may seem complicated at first. But it’s easier than you think.

The first step is to decide which type of financing you want to offer. For instance, there are different customer financing programs available, such as:

A) Buy Now, Pay Later (BNPL)

It's a short-term financing option provided by a third-party provider. It means you get paid upfront by the provider while they take over the risk of recovering the payments. Additionally, they charge interest from customers and a service fee from the business on every payment.

B) Medical Credit Cards

Medical credit cards are popularly used by patients to pay for healthcare services. Hence, providers can consider accepting such payment options. These cards work similarly to credit cards, and patients usually need a credit score over 620 to qualify.

C) Flexible Payment Plans

This versatile payment option is ideal for businesses as well as healthcare providers to offer financial ease and flexibility to their customers and patients. These plans work where traditional methods fall short because

Hence, the business gets paid in regular payments, generating recurring revenue and ensuring a steady cash flow. Additionally, some platforms, such as Credee payment options, do not even require a credit check, making them more widely accessible.

Ready to Automate Your Debt Recovery? Choose Credeebill

What Are the Top Customer Financing Solutions?

A range of third-party providers offer hassle-free technology to make the process as smooth as possible. Here are the top third-party customer financing solutions to consider:

1. PayPal

PayPal has over 280k active users. It provides a type of BNPL service where customers can split purchases up to $1500 into 4 interest-free payments. The customers are required to make a down payment and the rest in 3 installments (bi-weekly).

2. Klarna

It is a popular BNPL customer financing solution that is widely used by over 250k merchants. It works similarly to PayPal by allowing 4 interest-free, biweekly payments. However, there is no predefined limit on spending for customers.

3. Credee

It's a payment solution that allows businesses to create flexible payment plans customized to their customers' preferences. It gives businesses more control over setting up plans for any duration, from 3 months to 48 months, as needed.

Moreover, the providers can use Credee to create payment plans for a service value of a maximum of $20k. Hence, it is ideal when it comes to businesses that offer high-ticket services. Furthermore, there are different payment plans, including SimpleeFi (12-month Deferred interest plan) and KeepeeFi which allow the providers to set and keep the interest.

4. AfterPay

It is another BNPL service that works similarly to PayPal and Klarna. It helps users pay for services in 4 equal, interest-free installments, with each being 25% of the total cost. The repayment period for interest-free payments is 4–6 weeks. However, it also offers monthly payment options to budget purchases between $400 to $4,000 over a 6–12-month period and charges a predetermined interest rate.

Discover Credee's Diverse Payment Options!

Schedule a DemoHow to Integrate Customer Financing Solutions?

Once you know which customer financing technology or option you want to go with, you can get started by creating your account. For instance, if you choose PayPal, you need to set up a PayPal business account to receive payments. Then you can set it up at your point-of-sale (POS) system and website. Similarly, you can set up an account for AfterPay, Klarna, and Credee.

Credee allows businesses to offer payment plans directly from the website and automates a range of key business processes. Hence, it makes payment plan management a breeze.

Final Thoughts

There are several third-party customer financing solutions, each with its own set of features and benefits. For instance, PayPal’s BNPL service offers 4 interest-free payments, while Klarna provides similar options with no predefined spending limits. AfterPay offers 4 interest-free installment plans with repayment periods of 4 to 6 weeks and also has a 6-month to year-long payment plan option. However, Credee stands out with its payment plan flexibility, long-term plans, transparency, and customization options.

Ultimately, the choice depends on your specific business needs and goals in the long run. So make sure to assess each option and consider how it aligns with your objectives to make an informed decision that benefits both your business and your customers.

FAQs: Your Top Customer Financing Queries Answered

1. Is There a Customer Financing Solution That Doesn’t Require Credit Checks?

Yes, Credee is a leading provider of flexible payment options with a ‘No Credit Checks’ policy. It provides instant approvals to 97% of applicants, ensuring easier access to your services.

2. How Safe Is It to Offer Payment Options With Credee?

Credee is a BBB-accredited provider. It has the highest-grade security encryptions to ensure secure payments and legal compliance.

Additionally, it protects your payments, so you get paid what you’re owed while minimizing the risk of missed or non-repayment issues. Hence, it makes it safer and more convenient to offer payment plans in every aspect.

3. Is Offering Flexible Payment Options Worth It?

Unlike other financing solutions, providers don’t receive the full payment upfront when offering payment options. However, considering the long-term sustainability, offering flexibility in payments via payment plans pays off in the following ways:

- Opportunity to foster stronger customer relationships

- Generate recurring revenue and financial stability

- Retain & attract more customers

- Foster customer loyalty

- Sustainable growth

- Expand service reach to a wider customer base.

Wondering, ‘How to Offer Financing to Your Customers?'