Welcome To The February Edition Of The Credee Newsletter!

Our February newsletter focuses on unveiling the secret to effective past-due account management for your business, tips to enhance your financial strategies and new possibilities. Let’s dive in!

The Wait Is FINALLY Over!

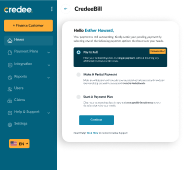

CredeeBill Is Here!

CredeeBill handles the different stages of debt collection on your behalf so that you have a better chance of repeat business from customers with temporary cash flow problems. At the same time, it effortlessly streamlines the recovery of overdue payments, ensuring you can manage your collections hassle-free.

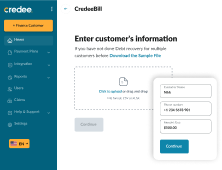

All begins with a single step - just add the list of your past due accounts into the system, and CredeeBill takes it from there!

Here’s How It Works:

Step 1:

Upload a list of all your past-due accounts.

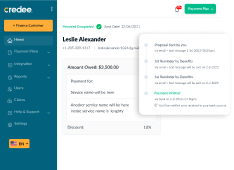

Step 2:

Credee automatically sends automated reminders and uses friendly reminders to encourage customers to pay off the balance.

Step 3:

The customers can choose how they want to pay.

Step 4:

You start receiving the money in your business’ bank account as soon as the customer starts paying.

SimpleeFi With Deferred Interest

This payment plan features deferred interest for up to 12 months. Plus it is an appealing choice for customers who need extra time.

We're thrilled to announce the latest upgrade to Credee's SimpleeFi With Deferred Interest! Elevate the customer experience by offering an entire year of interest-free installments during the extended 12-month deferred period.

It's a beneficial situation for both your customers and your business: While your customers enjoy flexible payment terms, you enjoy enhanced business opportunities with added security.

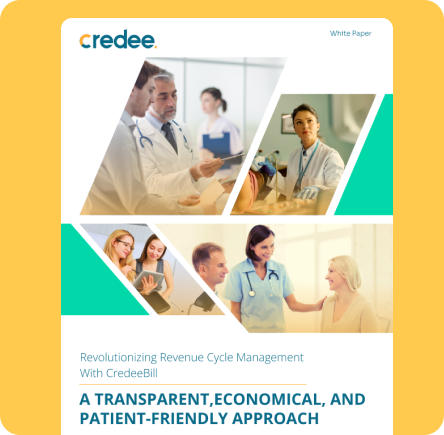

Make Your Revenue Cycle Management More Efficient With CredeeBill

Explore the full potential of CredeeBill by diving into our latest whitepaper. Gain in-depth insights into how this feature automates debt recovery through payment reminders, enticing offers, flexible payment plans, and advanced tactics to optimize revenue collection.

COMING UP NEXT>>>

Partner App

Our Partner App is gearing up for launch, promising accessibility and unmatched convenience. Brace yourselves for an experience like never before!

Stay tuned for the grand reveal—it's going to be well worth the wait!

Smart Moves, Big Results: Credee’s Spotlight Features

Web Connect – Easy Integration, Convenient Payment Plans.

Explore the full potential of CredeeBill by diving into our latest whitepaper. Gain in-depth insights into how this feature automates debt recovery through payment reminders, enticing offers, flexible payment plans, and advanced tactics to optimize revenue collection.

Did You Know?

Offering flexible payment options on the website boosts the conversion rate by as much as 30%.

CredeeFi – Say Goodbye to Hidden Fees or Additional Charges.

No additional costs are hiding in the fine print – what you see is what you get. CredeeFi not only aids in saving on potentially high merchant fees but also allows you to construct a solid financial model for yourself.

Your Feedback Matters To Us!

We understand that you may have questions about Credee and its features. To ensure we provide the information that matters most to you, we invite you to share your questions with us.

Stay Tuned for the Answers

We'll compile the most frequently asked questions and provide detailed answers in our next newsletter.

Thank you for choosing Credee as your trusted ally.

We are here to support you at every step. If you have any questions, suggestions, or success stories to share, we're all ears.

Follow us on socials and find out about our new features and updates regularly.

Credee © . All rights reserved.