Introduction To CredeeBill

CredeeBill revolutionizes the approach to overdue accounts by combining the effectiveness of a collection agency with the tailored oversight of in-house management.

This cutting-edge, user-friendly accounts receivable management system streamlines the debt management process, offering an innovative solution for businesses and individuals alike.

Its primary goal is to facilitate the efficient management of financial responsibilities, ensuring a seamless and effective experience in handling accounts receivable.

Features of CredeeBill

User-Friendly Interface

Designed for ease of use, allowing quick navigation and management of accounts.

Customizable Reports

Generates detailed reports tailored to specific needs for better financial analysis.

Real-Time Tracking

Offers up-to-date tracking of payments and outstanding balances.

Secure Platform

Ensures high-level security for all transactions and personal data.

Automated Reminders

Sends reminders to customers for upcoming and overdue payments.

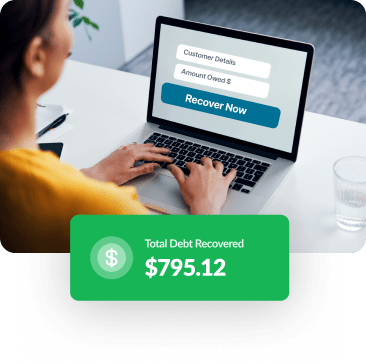

Collect Anytime, Anywhere

With CredeeBill, your collection process never sleeps. Our 24/7 collection capability ensures that your efforts continue round-the-clock, maximizing your chances of successful recovery.

How CredeeBill Works

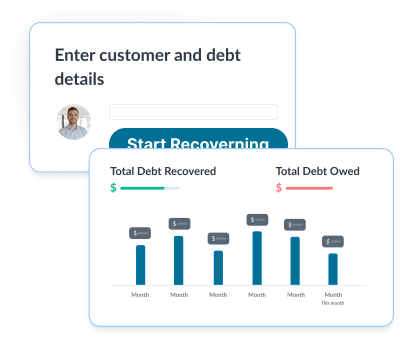

Setting Up and Using the System

Input details of receivables, and Credee system will do the rest.

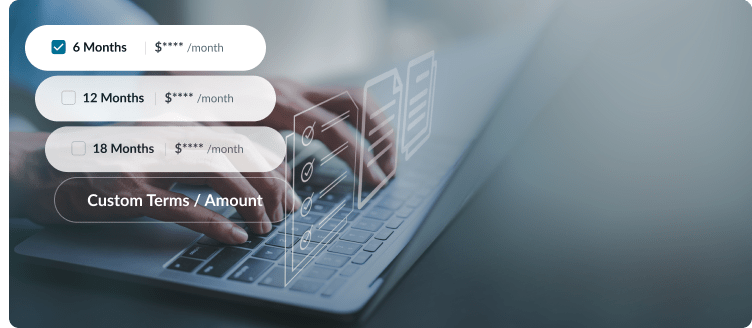

Choose a suitable payment plan(full payment, partial payments, or a personalized plan) and select a preferred payment method (ACH, credit/debit card, digital wallets).

Automated Reminders:Automated reminders are sent for due payments to ensure timely collection.

Reporting:Utilize the reporting feature to generate financial reports for a comprehensive overview of accounts receivable status.

Dashboard:Familiarize yourself with the dashboard, where you can view outstanding balances, track payments, and access various features.

How CredeeBill Works

Making and Receiving Payments

Payment Initiation:Customers can initiate payments based on their chosen plan.

Receiving Payments:Businesses receive notifications and updates on received payments through the system.

Adjustments and Updates:Both parties can adjust payment plans or methods if needed, with all changes updated in real-time on the system.

Debt-Clearing Options in CredeeBill

Full Payment Option

This option allows customers to clear their entire debt in a single payment.

Benefits:

It's ideal for those who prefer a quick resolution and can afford an immediate settlement. This option simplifies the debt clearance process and eliminates the need for tracking multiple payments over time.

Partial Payment Flexibility

Customers can opt to make smaller, more manageable payments towards their debt.

Benefits:

This is particularly beneficial for individuals who need to spread their financial obligations over a period of time, making it easier to manage monthly budgets without significant strain.

Flexible CredeeBill Payment Plan

CredeeBill provides personalized payment plans, tailored to align with each customer's unique financial situation.

Benefits:

These customized plans offer a more realistic and manageable approach to debt clearance, ensuring that customers are not overburdened by their financial commitments.

Multiple Payment Methods

The system accommodates a variety of payment methods, including ACH transfers, debit and credit card payments, and digital wallets like Apple Pay and Google Pay.

Benefits:

This diversity in payment options enhances convenience and accessibility, allowing customers to choose the method that best fits their lifestyle and preferences.

Integrating These Options into the CredeeBill System

Customer Assessment

Upon entering the CredeeBill system, customers are given the opportunity to assess their financial situation and choose the most suitable debt-clearing option.

Plan Customization

For those opting for the Flexible CredeeBill Payment Plan, the system guides them through a process of tailoring a payment plan that aligns with their financial capabilities.

Payment Process

Customers select their preferred payment method, which is then integrated into their chosen debt-clearing option, whether it's a full payment, partial payments, or a personalized payment plan.

Ongoing Support and Adjustment

The system provides ongoing support and the flexibility to adjust payment plans if a customer’s financial situation changes, ensuring continuous alignment with their current capabilities.

Advantages of CredeeBill

For Businesses

Efficiency

Streamlines the process of managing accounts receivable, saving time and resources.

Flexibility

Offers various debt-clearing options, catering to different financial situations of customers.

Improved Cash Flow

Facilitates quicker payment processing, leading to improved cash flow for businesses.

Customer Satisfaction

Enhances customer experience through flexible payment options and ease of use.

Reduced Errors

Automation reduces the likelihood of errors in billing and payment tracking.

For Customers

Customer Centricity

The flexibility in payment options puts the customer’s needs and capabilities at the forefront, enhancing their overall experience and satisfaction.

Enhanced Accessibility

With multiple payment methods, customers can choose the one that best suits their preferences and circumstances, making the payment process more user-friendly.

Improved Financial Management

The option to make partial payments or customize a payment plan allows customers to manage their finances more effectively, without overburdening their monthly budgets.

Streamlined Process

CredeeBill's intuitive interface and easy-to-use features make the process of managing and paying off debts less intimidating and more efficient.

The CredeeBill system's diverse debt-clearing options offer a comprehensive solution tailored to meet various financial needs and preferences.

By providing these flexible choices, CredeeBill underscores its commitment to customer-centric service, making debt management a more accessible and less daunting task for its users.