Introduction To CredeeFi Payment Plan

The CredeeFi Payment Plan is an affordable solution designed to provide customers with accessible payment options without adding extra fees for businesses.

Ideal for companies seeking a secure and low-risk method to offer their services, our plan safeguards up to 90% of the principal amount . This protection creates a safety net, enabling you to confidently serve a wider customer base.

The CredeeFi Payment Plan is an affordable solution designed to provide customers with accessible payment options without adding extra fees for businesses.

Ideal for companies seeking a secure and low-risk method to offer their services, our plan safeguards up to 90% of the principal amount . This protection creates a safety net, enabling you to confidently serve a wider customer base.

This tutorial will guide you through the features, benefits, and implementation process of the CredeeFi Payment Plan.

Features of the CredeeFi Payment Plan

No Additional Fees for Businesses

Businesses can receive their full service cost.

Competitive Interest Rates for Customers

Interest rates to customers are lower compared to standard market rates.

Payment Protection

If a customer misses a payment, Credee takes on the debt and protects up to 90% of the principal payment.

Reserve Payment Mechanism

The first payment made by the customer is held as a reserve. This amount is released along with the final payment when the contract is paid in full, ensuring an additional layer of financial security.

Advantages

For Businesses

- Attracts more customers by offering a budget-friendly payment option.

- Reduces financial risk with Credee assuming responsibility for missed payments.

- Enhances customer loyalty and repeat business by providing flexible payment solutions.

For Customers

- Makes higher-priced services more accessible through manageable payments.

- Saves money with lower interest rates.

- Offers peace of mind with hassle-free payments.

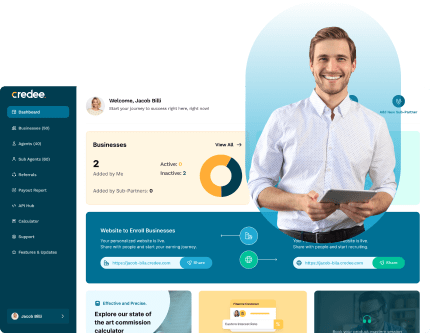

Implementing the CredeeFi Payment Plan

![!!$data->screen4->desktop_left_image['alt']!!}](https://cdn.credee.com/wp-content/uploads/2024/04/nfpp_screen4_img1-1.png)

Assess Suitability: Determine if the CredeeFi Payment Plan aligns with your service offerings and your customer base.

Educate Your Team: Train your staff on the details of the plan, so they can effectively communicate its benefits to customers and address any questions.

Promote the Plan: Advertise the availability of the CredeeFi Payment Plan to your customers through marketing materials, website integration, and during service consultations.

Manage Contracts: Utilize the Credee panel to manage customer contracts, keeping track of payments, and the reserve amount.

Customer Support: Provide excellent customer service to assist clients in understanding and managing their payment plans.

Assess Suitability: Determine if the CredeeFi Payment Plan aligns with your service offerings and your customer base.

Educate Your Team: Train your staff on the details of the plan, so they can effectively communicate its benefits to customers and address any questions.

Promote the Plan: Advertise the availability of the CredeeFi Payment Plan to your customers through marketing materials, website integration, and during service consultations.

Manage Contracts: Utilize the Credee panel to manage customer contracts, keeping track of payments, and the reserve amount.

Customer Support: Provide excellent customer service to assist clients in understanding and managing their payment plans.

CredeeFi Payment Plan is an excellent way for businesses to offer flexible payment options to their customers without incurring additional fees.

By implementing this plan, businesses can enhance their service accessibility, improve customer satisfaction, and ensure a steady cash flow. With its customer-centric approach and protective features, it's a win-win solution for both businesses and their clients.