Credee: A New Era of Business Financing

Credee, a pioneering platform in the realm of financial solutions for businesses, has positioned itself as an indispensable tool, especially in today's dynamic economic landscape. The essence of Credee lies in its innovative approach to Payment Plans, Payment Processing, and Accounts Receivable management, addressing core financial challenges faced by businesses across various sectors.

Credee revolutionizes how businesses manage payment plans, process payments, and handle accounts receivable, thereby unlocking unprecedented opportunities for steady monthly income and sustainable growth This groundbreaking platform offers versatile and tailor-made solutions, designed to accommodate a diverse clientele, including those who may have limited opportunities for conventional financing.

Credee revolutionizes how businesses manage payment plans, process payments, and handle accounts receivable, thereby unlocking unprecedented opportunities for steady monthly income and sustainable growth This groundbreaking platform offers versatile and tailor-made solutions, designed to accommodate a diverse clientele, including those who may have limited opportunities for conventional financing.

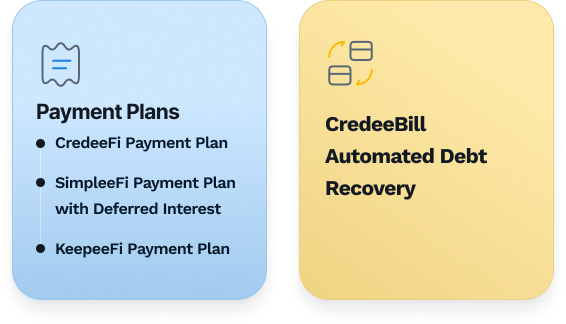

Payment Solutions Provided by Credee

With Credee, your business is not just offering a services; you're offering a financial solution that empowers your customers and enhances your operations. Embrace this new era of customer financing and watch your business grow.

Key Features for Businesses

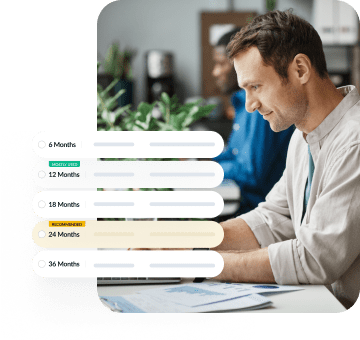

Flexible Payment Plans

Offers businesses and customers unparalleled flexibility and control.

This feature allows businesses to tailor payment solutions to individual customer needs, breaking down the barriers of large, upfront costs and opening the door to a broader customer base.

Benefits:

Increased Sales and Revenue:

Businesses can attract a wider range of customers, including those who are denied financing. This can lead to increased sales and higher revenue.

Market Competitiveness:

Offering flexible payment options can be a key differentiator in a competitive market, making a business more attractive to potential customers.

Enhanced Customer Satisfaction:

Flexible payment plans cater to the financial needs of different customers, enhancing their overall experience and satisfaction. Happy customers are more likely to return and recommend the business to others.

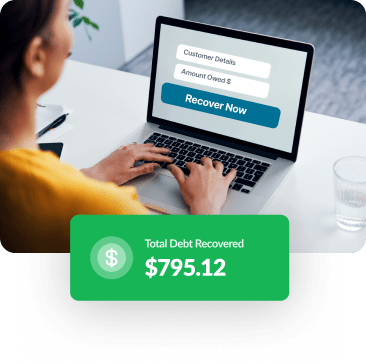

CredeeBill - Automated Debt Recovery

The perfect hybrid between a collections agency and In house collections.

24/7 collection capability means you can collect anytime, anywhere, significantly boosting your chances of successful recovery. CredeeBill is not just a tool; it's your partner in optimizing your financial operations.

Benefits

Collect Anytime, Anywhere:

Your collection process never sleeps. Our 24/7 collection capability ensures that your efforts continue round-the-clock, maximizing your chances of successful recovery.

Efficiency:

Streamlines the process of managing accounts receivable, saving time and resources.

Improved Cash Flow:

Facilitates quicker payment processing, leading to improved cash flow for businesses.

Embrace Credee

With Credee, your business is not just offering a service; you're offering a financial solution that empowers your customers and enhances your operations.

Implementing these features can significantly enhance a business's operational efficiency, customer base, and financial health. Embrace this new era of customer financing and watch your business grow.