It’s no news that healthcare access is one of the top concerns in the US, as many Americans struggle to afford even basic healthcare services. This is primarily due to the ever-rising impact of inflation on medical costs. What is alarming is that not only do Americans struggle to afford healthcare services, but they also face challenges in obtaining health insurance.

| Notably, according to health insurance statistics from the Centers for Disease Control and Prevention, uninsured non-elderly adults, aged 18-64, report that the main reason why they don't have health insurance is that the cost is too high. |

Ironic, isn't it? The very thing aimed at making healthcare services affordable is, in itself, a costly affair. Will this situation subside? That is uncertain. In fact, Affordable Care Act (ACA) marketplace insurers are requesting a 6% average premium hike for 2024, due to inflation and higher levels of care, in the aftermath of the pandemic.

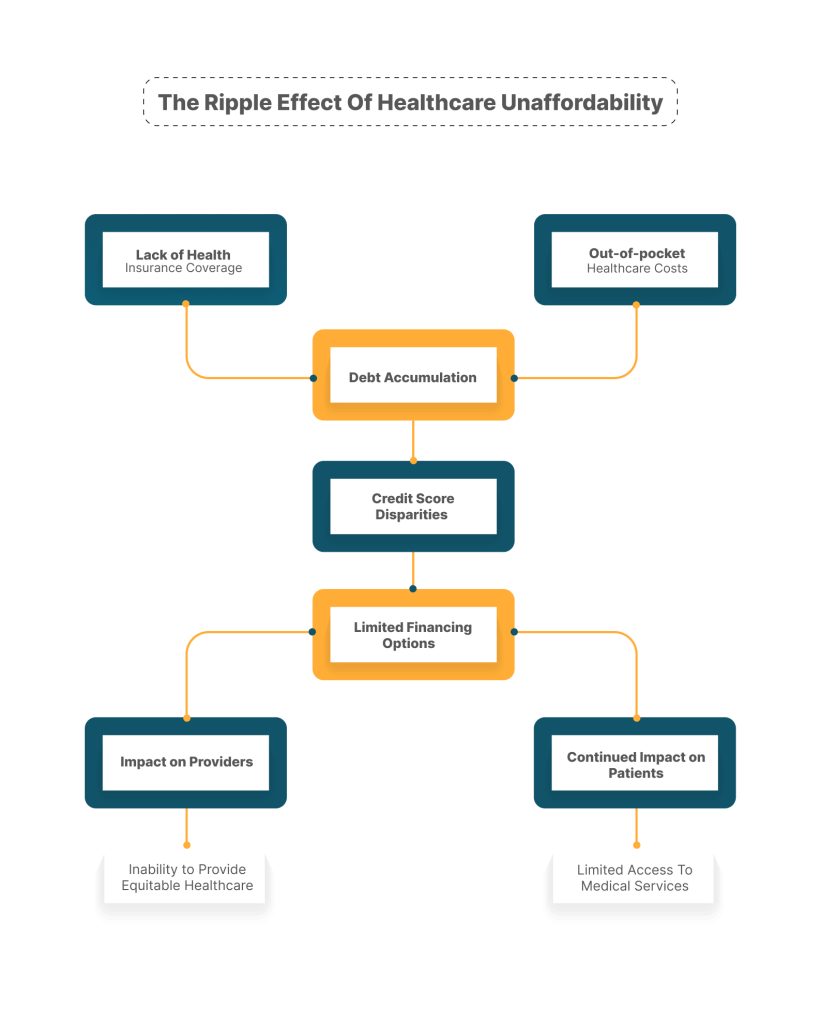

The repercussions? Postponed healthcare access, heightened reliance on personal or medical loans, accruing debt, adverse effects on credit scores, and an overarching setback in one's financial well-being.

Now, the question remains - Is there a way out of the vicious loop? Let’s deliberate.

| In this blog, we’ll discuss: - What Can Limit Access To Health Care Services - The Ripple Effect Of Healthcare Unaffordability - The Implications Of High Medical Costs And Low Credit Scores - Credee To The Rescue: The Way Forward For Accessible Healthcare - Benefits Of Credee’s Flexible Payment Plans |

What Can Limit Access To Health Care Services?

1. Barriers To Health Insurance

Affordability In Question

While health insurance helps individuals manage their healthcare expenses, its affordability remains a challenge for many. Resultantly, millions of Americans lack coverage.

Coverage Gaps

Now, even among those with health insurance, significant out-of-pocket expenses ranging from 30% to 80% of total healthcare costs have become a prevalent challenge.

Discover top alternatives to medical credit cards for smarter healthcare financing options today.

2. Medical Debt Challenges

Dependence On Medical Loans

Insufficient or restricted insurance coverage often compels individuals to resort to medical loans as a means to address healthcare expenses.

Medical Debt Accumulation

Over time, many individuals end up with healthcare debt. That's right, A U.S. survey in March 2022 revealed that 62% of uninsured adults under 65 reported healthcare debt as did 44% of insured adults.

Extent Of Medical Debt

Medical debt is not a trivial concern. Approximately 23 million U.S. adults, nearly 1 in 10, grapple with significant medical debt exceeding $250.

Disparities In Debt

In some communities and regions, the debt challenge is even more prevalent. For instance, higher debt was reported by Black Americans, individuals in the South, and residents in states without Medicaid expansion.

3. Credit And Healthcare Access

Impact On Credit Score

Medical Debt not only impacts healthcare accessibility but also an individual's overall financial well-being by affecting their credit score.

Notably, nearly 1 in 3 U.S. consumers with subprime credit (580-669) face obstacles such as higher insurance premiums and difficulties qualifying for healthcare loans.

Disparities In Credit Scores

Just like medical debt, there are concerns about disparities in credit scores. For instance, in 2021, credit score disparities were evident with White communities at 727, Hispanic communities at 667, and Black communities at 627.

Credit Impact On Medical Loans

Securing medical loans, especially for those with subprime credit or considered 'credit invisible,' can be challenging. All circling back to the primitive concern of high healthcare costs.

The Implications Of High Medical Costs And Low Credit Scores For Patients And Providers

| Challenges | Patients | Providers |

|---|---|---|

| Access to Healthcare | Limited access to essential medical services due to high costs. | Balancing the provision of quality care with financial constraints. |

| Delayed or Avoided Treatment | Postponing necessary medical care due to financial concerns. | Treating patients who delay seeking care, leads to more severe conditions. |

| Debt and Financial Strain | Accumulating medical debt affects overall financial well-being. | Managing unpaid bills, potentially impacting the financial health of the healthcare facility. |

| Impact on Health Outcomes | Compromised health outcomes due to delayed or avoided treatment. | Balancing financial pressures with the imperative to provide optimal patient care. |

| Credit Score Implications | Negative impact on credit, affecting future financial opportunities. | Balancing the need for revenue with the ethical considerations of patients’ financial struggles. |

| Limited Preventive Care | Reduced engagement in preventive measures due to cost concerns. | Limited ability to promote and provide preventive services, leading to potential long-term health issues. |

| Increased Emergency Care | Higher reliance on emergency services due to delayed primary care. | Increased burden on emergency departments, leading to longer wait times and resource strain. |

| Administrative Burden | Navigating complex billing and insurance processes. | Dealing with increased administrative work to manage billing, collections, and financial assistance programs. |

| Patient-Provider Communication | Difficulty in open communication about financial challenges affecting treatment. | Strain on the patient-provider relationship due to billing concerns and potential disputes. |

| Equity and Accessibility Issues | Disparities in healthcare access based on financial status. | Struggling to maintain equitable healthcare services while dealing with financial constraints. |

The picture is clear. The challenges are evident. And the loop is vicious. High healthcare costs, limited insurance coverage, medical debt, and its impact on credit score, all trap those in need of medical care in an interlinked maze. And it is a concern both healthcare providers and patients share, in parts, if not equally.

But there is always a way out. Many organizations, government and private, step in with financial assistance programs and charities, to offer respite to patients in need of healthcare services, especially those in dire need. But even then, not all qualify. Especially not those who may not require the service urgently or for medically necessary reasons, but rather to lead a better life, for instance, a bariatric surgery. So, what then?

Supercharge Your Growth with Flexible Payment Plans!

Boost your business journey with payment flexibility customized to meet your business needs.

Enroll NowCredee To The Rescue

Amidst the ongoing healthcare accessibility crisis, healthcare providers across the states are adopting patient payment plans. And this is where Credee comes into the picture- to facilitate these payment plans. These flexible payment options enable providers to offer patients the choice of a flexible payment plan, allowing them to access their services without having to pay a lump sum upfront amount.

Why Credee?

- Seamless website integration for a smooth user experience.

- Multilingual support for diverse customer accessibility.

- Streamlined payment process with automated collection.

- NO CREDIT CHECK policy for inclusivity.

- Flexible payment plans for varying financial situations.

- 97% approval rate for widespread customer approval.

Benefits Of Credee’s Flexible Payment Plans For Patients And Providers

| Benefits For Patients | Benefits For Providers |

|---|---|

| Cover unexpected medical emergencies or accidents. | Ensure a consistent revenue stream. |

| Afford healthcare services despite having a low credit score. | Retain patients by making healthcare costs more manageable. |

| Afford expensive medical procedures and surgeries. | Reduce the risk of unpaid bills and lower bad debt expenses. |

| Bridge the gap of limited or no health insurance coverage. | Receive regular payments and aid cash flow management. |

| Access dental, orthodontic, and vision care. | Simplify the billing process. |

| Support mental health treatment and therapy. | Reduce administrative overhead costs. |

| Manage ongoing costs of chronic health conditions. | Increase customer satisfaction and encourage positive feedback. |

Conclusion

The pervasive challenges of healthcare accessibility in the United States. And the answer to “What can limit access to health care services?” is more complex than high medical costs and limited insurance coverage. It’s a complex web impacting both patients and providers. The ripple effect includes delayed treatment, financial strain, compromised health outcomes, and credit score implications.

However, amidst this crisis, innovative solutions like Credee's flexible payment plans come to the rescue by fostering accessible healthcare. By providing patients with inclusive and manageable payment options, these initiatives strive to break the cycle of healthcare unaffordability, fostering better access, financial stability, and improved overall well-being for both individuals and healthcare providers.

Take advantage of new opportunities for your practice and patients!

Schedule a Demo