Customer financing has made expensive services accessible to those who otherwise can’t afford them. With it, customers can buy a service and pay for it over time rather than upfront and out of pocket.

So, if you're not offering alternative financing options to your clients, you're probably losing big time to your rival businesses that do. It is important to prioritize your customers' needs and cater to their changing demands. And you can make it happen with customer financing.

Running your own business can be stressful, but getting clients keeps your business afloat. Here are some effective strategies to attract new customers.

In this blog, we’ve listed alternative financing options that your business should offer to attract more customers and increase revenue. But first, let’s look at its benefits.

BENEFITS OF CUSTOMER FINANCING OPTIONS FOR BUSINESSES

1. Enhances Conversion Rate

In a study conducted by Forrester, businesses experience a 32% increase in conversion rates after offering quality financing services to customers.

By allowing buyers to make payments in monthly installments that fit their budget, businesses can close more deals.

Through financing, you can eliminate the most significant obstacle to a closing sale - the high price. Customers love businesses that offer them the power to buy the services they want without paying the full price in one go.

Improve Your Business's Financial Performance by Introducing Flexible Payment Plans for Your Customers.

Enroll Now2. Boosts Brand Loyalty & Customer Retention

According to a survey, more than 93% of customers claim they prefer to purchase repeatedly from a company they trust.

Providing alternative financing options to customers and maintaining a lower price than your rival businesses can increase brand loyalty and customer retention. Your ability to maintain healthy, lasting relationships with customers offers you peace of mind to make result-driven financial decisions.

3. Improves Average Order Value (AOV)

AOV is the average value of all purchases made by customers. Through financing, businesses can upsell their customers and increase their brand’s AOV.

By providing customer financing options, businesses can be more moderate in changing what customers want to buy. They can persuade them to make big-ticket purchases by assuring them that they have the flexibility to pay.

A study reveals that around 30% of customers would not have bought services if it weren't for the flexible financing options.

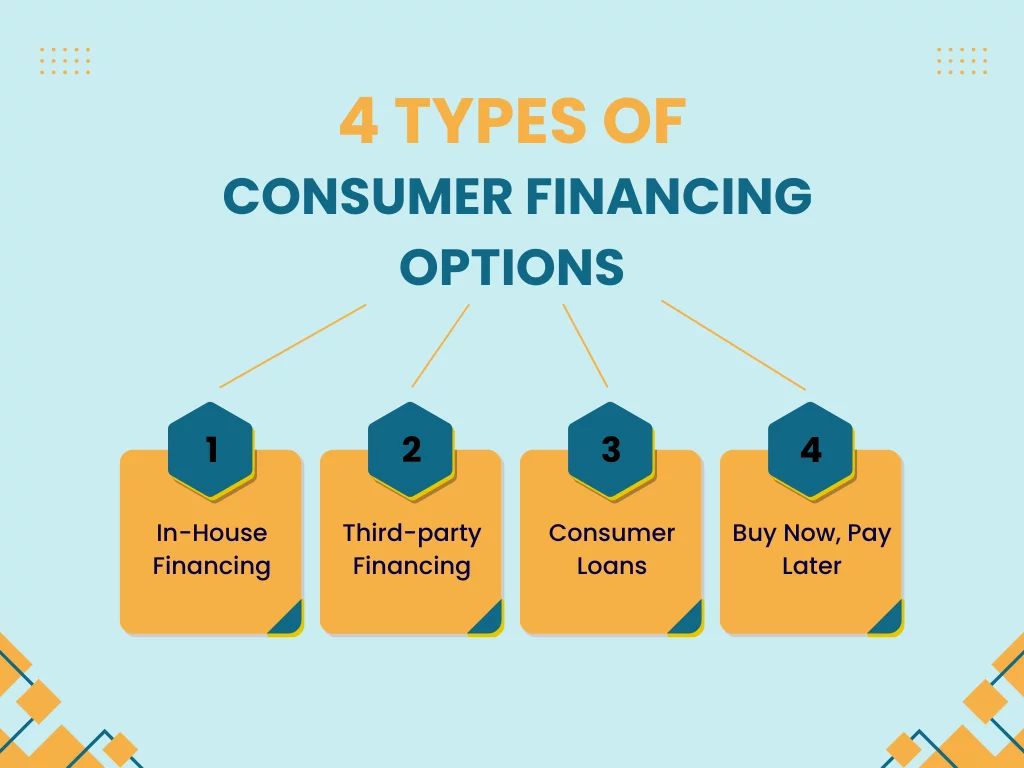

TYPES OF CUSTOMER FINANCING OPTIONS

1. In-House Financing - Primary financing or in-house financing is a type of financing where a business acts as a lender and offers payment plans to its clients. In primary financing, businesses have to pay for credit checks and collect payments.

2. Third-Party Financing - In third-party financing, businesses rely on third-party financers to act as a lender at POS. In these programs, customers get into a payment plan where they can divide the full amount for service into flexible monthly payments.

3. Customer Loans - Customer loans are a traditional form of financing suitable for big-ticket purchases. This type of financing doesn't report to credit bureaus and charges high-interest rates. It is best for businesses that offer services with high-price disparities. Customer loans are more regulated than other alternative financing options.

4. Buy Now, Pay Later - It is an emerging customer financing plan that empowers customers to purchase any service instantly and pay later. BNPL offers low-to-no interest rate payment plans and does not report to credit bureaus unless a customer misses a payment. It is a more affordable alternative to traditional lending.

Should Your Business Offer Payment Plans for Customers?

Offer flexible payment plans to boost your business growth, increase sales, and attract more customers. Start offering payment plans with Credee today!

Enroll NowHOW CREDEE PAVES THE WAY FOR YOUR BUSINESS

There are many available choices. However, some, such as bank loans, traditional lending, and healthcare loans, require extensive paperwork. They also have high-interest rates and low approval rates. Additionally, traditional lenders charge businesses for every payment received.

If you want to enhance your customers' payment experience without losing money to traditional lenders, Credee should be your go-to option. It is an innovative customer financing solution that can help your business earn recurring revenue.

Credee software ensures that your customers can access your services worry-free while protecting the payments in full. Credee makes your services more affordable and accessible by approving 97% of applicants, even those with a rocky credit history.

CONCLUSION

By offering a range of financing options, you can make your services more accessible and affordable to a wider range of customers, ultimately growing your sales and revenue.

To learn more about Credee’s customer financing options for your business

Schedule A Demo